Global markets weekly update

15.09.2025

U.S.

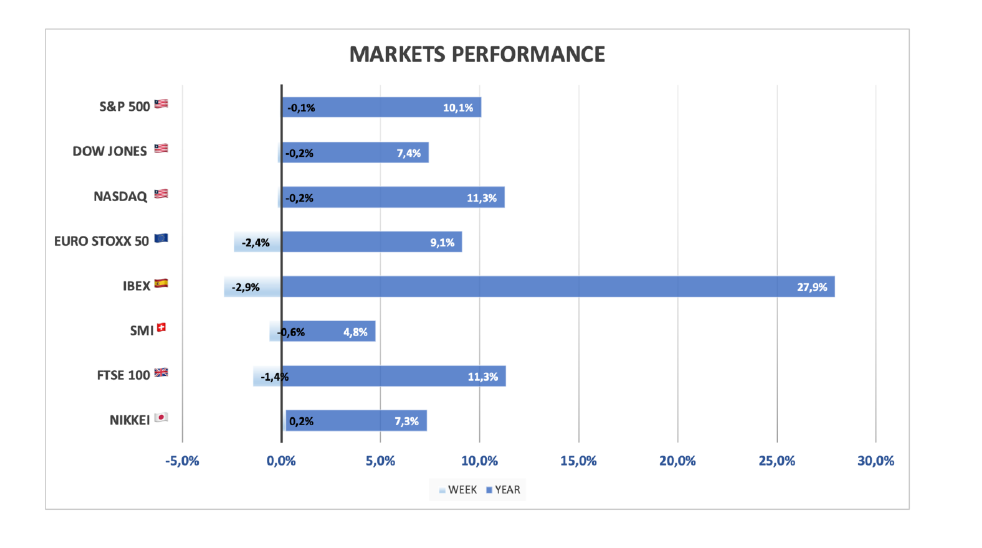

- Wall Street on Friday posted its best five-day advance in over a month, after a batch of inflation data further reinforced expectations of a Fed interest rate cut next week. For the week, the S&P500 added +1.6%, while the blue-chip Dow gained +1.0%. The Nasdaq advanced +2.0%.

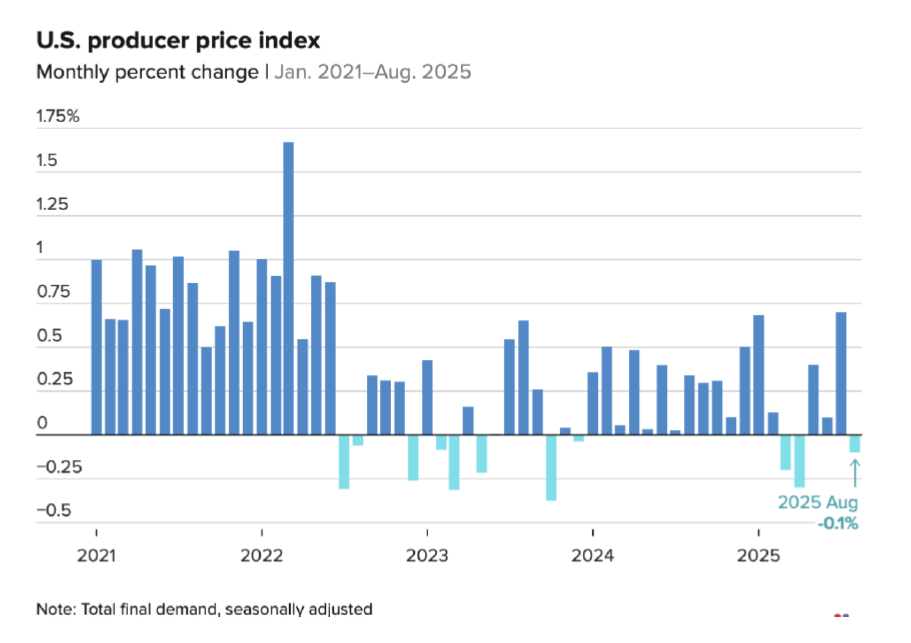

- On Wednesday, the August producer price index (PPI) unexpectedly slipped 0.1% on an monthly basis for both core and headline measures. The readings also decelerated on a yearly basis from July. Then, Thursday’s Consumer Price Index reading showed that U.S. inflation rose at a 2.9% annual rate in August, up from 2.7% the previous month. The month-to-month increase of 0.4% was slightly higher than economists’ consensus expectations, and core inflation excluding food and energy costs remained steady at a 3.1% annual rate.

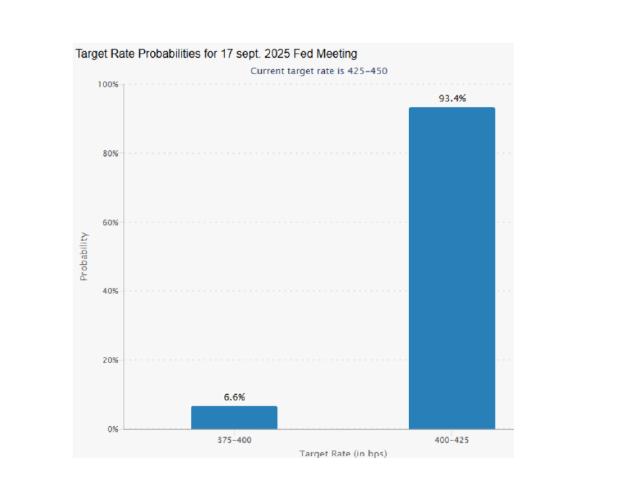

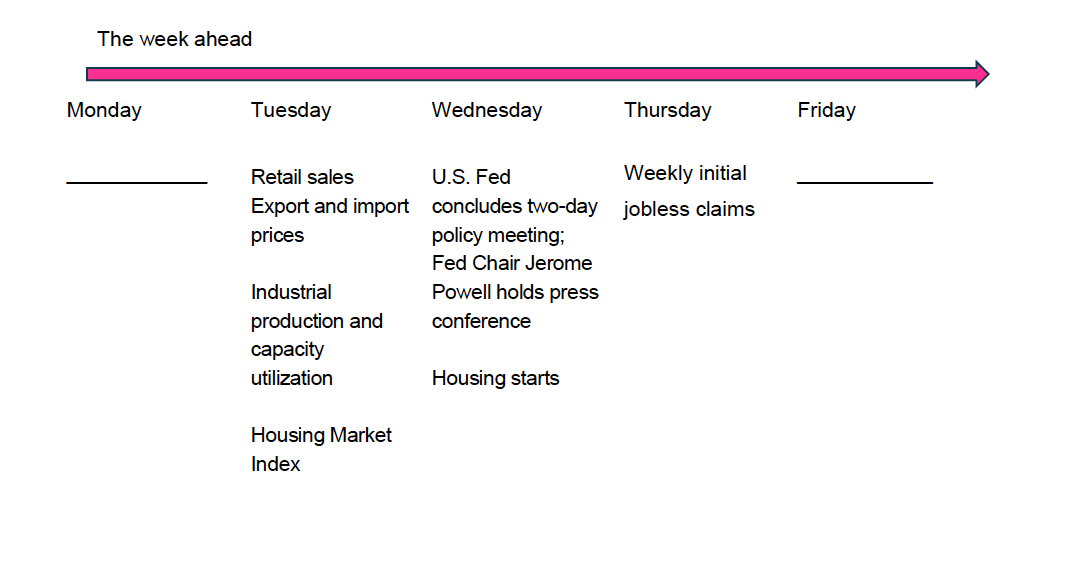

- Even though recent inflation readings have remained above the Fed’s long-term target of 2% annualized inflation, bond market trading continued to support expectations of an interest rate cut at the U.S. Federal Reserve meeting scheduled to end on Wednesday, September 17, in response to recent data showing a cooling in the labor market. As of Friday’s market, close, prices in rate futures markets implied a 93.4% probability that the Fed would cut by a quarter point, according to CME FedWatch.

- In earnings news, Oracle snatched the attention this week and also helped lift major indexes. The cloud software company missed quarterly top and bottom-line estimates and kept its forecast unchanged. But the value of committed revenue from signed contracts (that has not been recognized as revenue yet) more than quadrupled to USD 455B. Shares surged about 36%, adding nearly USD 250B to the stock’s market value and helping Oracle co-founder Larry Ellison dethrone Elon Musk as the world’s richest person.

-

- U.S. consumer sentiment slipped to the lowest level in four months, based on Friday’s preliminary monthly report from a University of Michigan survey. The decrease from a late August index reading of 58.2 to September’s preliminary figure of 55.4 marked the second monthly decline in a row and followed recent data showing weakening jobs growth.

- The price of gold futures climbed for the fourth consecutive week and set another new record high, briefly reaching USD 3,706 per ounce on Tuesday morning. Over the past four weeks, gold has risen more than 10%.

Europe.

- The Eurostoxx 600 ended the week 1.03% higher amid hopes of imminent rate cuts. Major stock indexes rose. Italy’s FTSE MIB climbed 2.30%, France’s CAC 40 Index advanced 1.96%, and Germany’s DAX added 0.43%. The UK’s FTSE 100 Index gained 0.82%.

- The ECB held its key deposit rate at 2%, as expected. ECB President Christine Lagarde restated that the eurozone was “in a good place” with inflation at 2%. The central bank also slightly raised its forecasts for inflation and economic growth this year. The ECB now projects 2.1% inflation in 2025 and 1.7% in 2026 and expects the economy to expand 1.2% this year compared with its previous estimate of 0.9% growth. Financial markets interpreted these figures a signal that the current rate-cutting cycle was over.

- German exports unexpectedly fell in July by 0.6% sequentially, as U.S. demand weakened due to trade tariffs. Exports to the U.S., Germany’s biggest trading partner, slumped 7.9% compared with June. However, exports to European Union countries rose 2.5% month over month.

- The UK economy failed to grow in July, following the biggest contraction in manufacturing output for a year. The Office for National Statistics (ONS) said the economy saw zero growth in the month, which was in line with expectations, following a 0.4% expansion in June.

- French President Emmanuel Macron appointed Sebastien Lecornu, a centrist defense minister, to replace Francois Bayrou as prime minister after he lost a confidence vote on a debt-reduction budget and his government collapsed.

Japan

- Japan’s stock markets ended the week higher, with the Nikkei 225 Index gaining 4,07% and the broader TOPIX Index up 1.78%, lifted by the announcement by Prime Minister Shigeru Ishiba that he intends to resign. His ruling Liberal Democratic Party will now hold an emergency leadership election on October 4, with investors likely focused on whether Ishiba’s successor adopts a more expansionary fiscal approach, possibly involving cuts to income and consumption taxes.

• There was some speculation that increased political uncertainty could delay further monetary policy tightening by the Bank of Japan. However, many investors continued to think that the central bank could still hike interest rates this year, as the economy and inflation develop in line with its estimates.

- Japan’s economy grew by 2.2% on an annualized basis in Q2 2025, exceeding the initial estimate of 1.0% and sharply accelerating from a downwardly revised 0.3% increase in Q1.

China

- Chinese equities continued their ascend, with the Shanghai Composite Index advancing 1.52% and the onshore blue chip CSI 300 gaining 1.38%, fueled by demand from cash-rich households in search of alternatives for higher returns amid low interest rates.

- On the economics front, data showed that deflationary pressures continue to weigh on China’s economy. The producer price index fell 2.9% in August year on year. Unlike most Western countries, China is in its third straight year of deflation, struggling with a protracted housing market downturn.

Portfolio considerations

Equities

With major stock indexes at record highs and elevated valuations, markets could experience volatility ahead, especially since September and October have historically coincided with increased market volatility and lower returns. We consider any coming bouts of volatility as opportunities for investors to diversify and to add quality investments at better prices. We believe this is especially true now that we appear to have more meaningful catalysts in place, including easing trade tensions, deregulation, and potential policy support in the form of moderate fiscal stimulus (the Big Beautiful Bill) and easing monetary policy.

Fixed Income

Bond yields dropped on expectations of Fed easing, with the 10-year Treasury yield briefly touching 4%. The steepening of the yield curve favors intermediate maturities over very long ones, which remain vulnerable to rising term premia due to inflation and fiscal concerns. In this environment, we think short-term bonds offer stability and liquidity for near-term needs, while longer-term bonds provide attractive yield opportunities. We continue to advocate seizing the yield advantage in high quality fixed income to build resilient portfolios, especially since equity valuations remain stretched. We recommend overweighting intermediate-maturity bonds (5-7 years), also less exposed to concerns over widening government budget deficits and rising debt levels. The primary source of return will be carry and not capital gains.

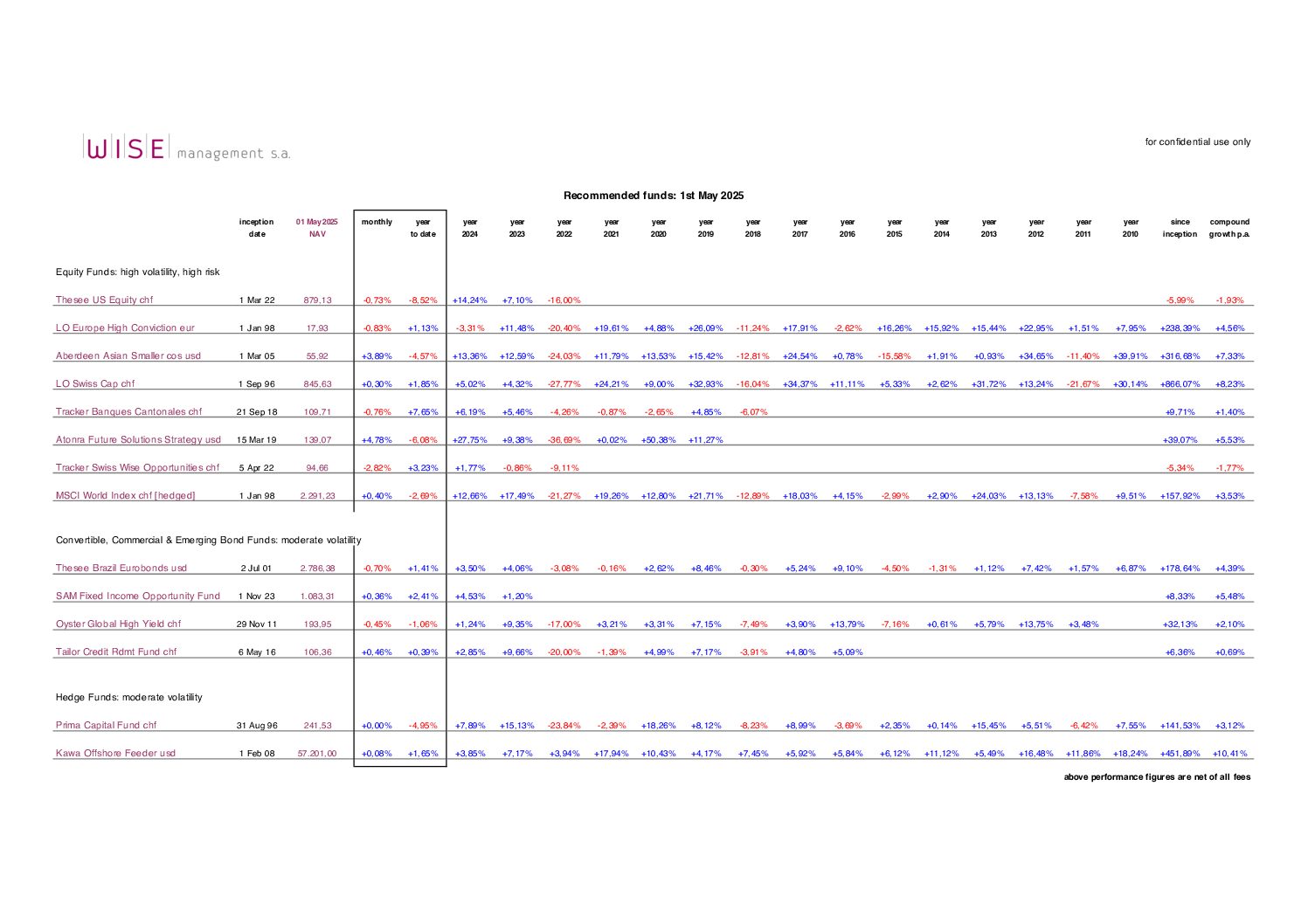

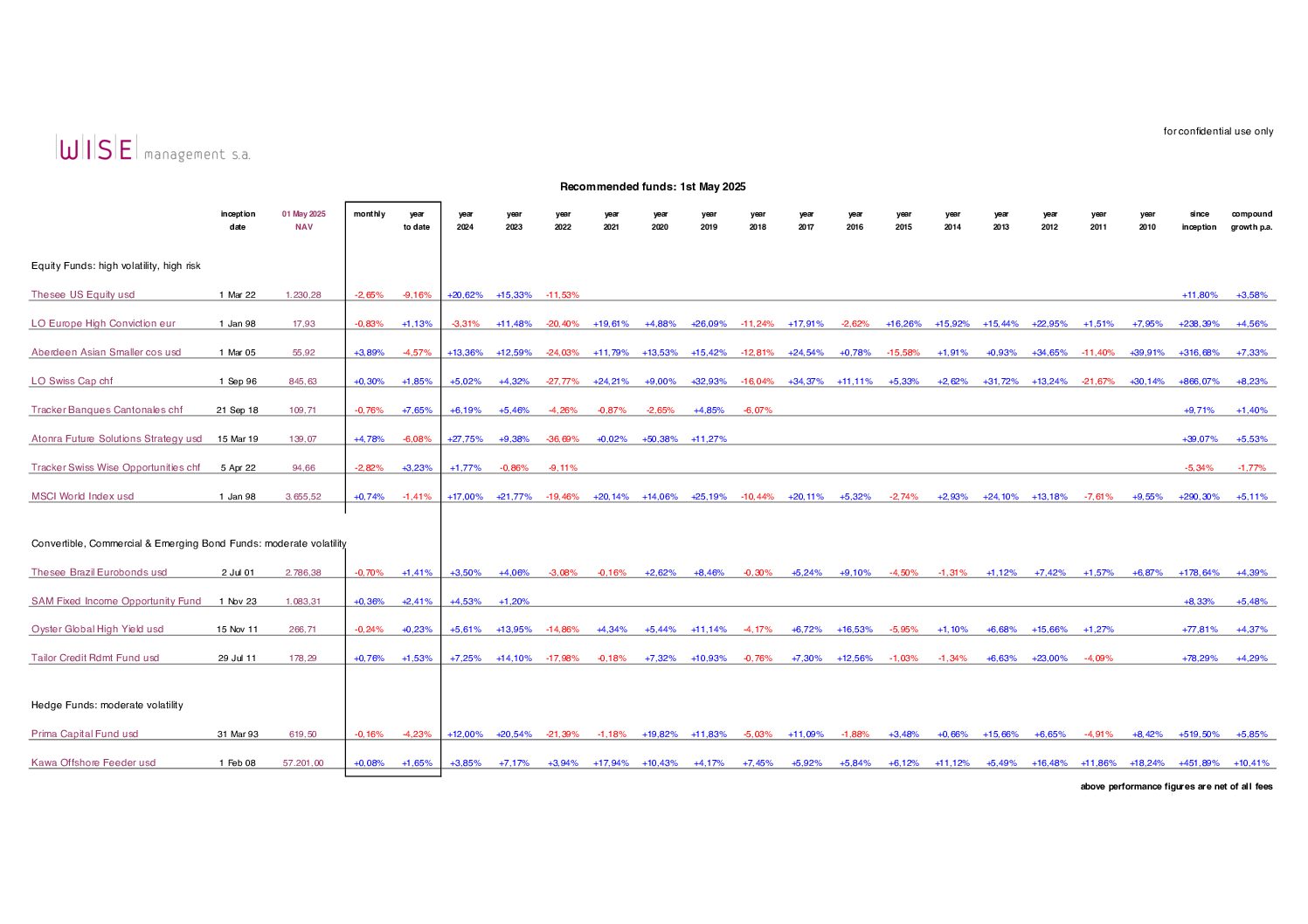

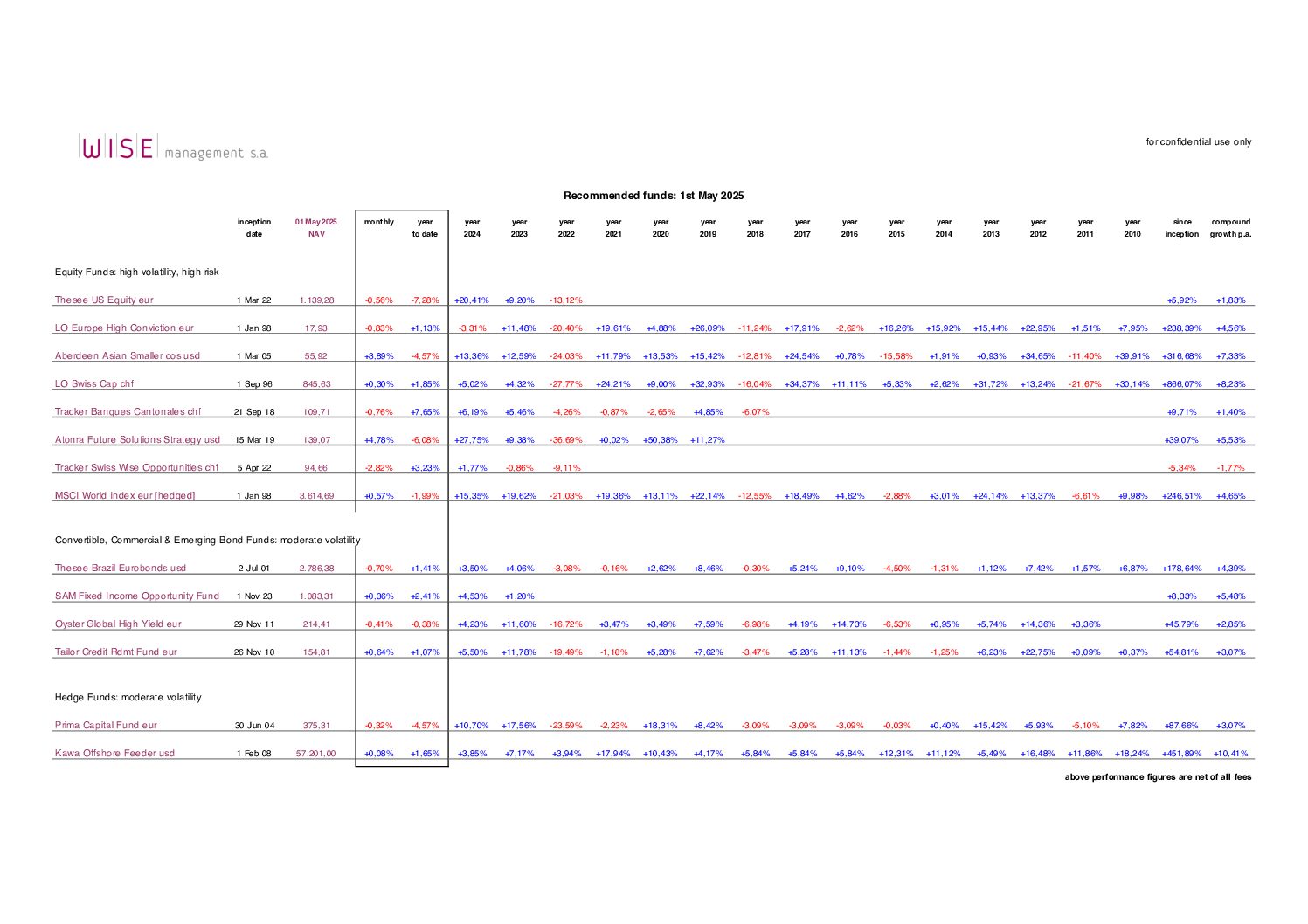

Selected Funds

08-2024

USD

EUR

CHF